Compostable capsule packaging is no longer a niche concept but a central theme in today’s coffee market. Single-serve coffee has undeniably reshaped consumer behavior, offering convenience and consistency at scale. Yet this growth has come at a cost. Each year, an estimated 60+ billion (industry estimates) capsules made of plastic and aluminum are consumed globally, with global recycling rates cited in industry reports are often under 30% due to material complexity and low consumer sorting rates.

What makes capsules especially contentious is consumer perception. Coffee lovers are far more likely to associate capsule waste with environmental harm than with whole bean or ground coffee packaging. In markets like the EU and North America, where eco-conscious buyers dominate, this negative perception directly influences brand loyalty and purchasing decisions.

At the same time, regulatory frameworks are tightening. Extended Producer Responsibility (EPR) laws in Europe, bans on single-use plastics in France, and California’s SB 54 mandate in the US all signal the same trajectory: capsule packaging must become recyclable or compostable. These policy drivers are already changing how retailers and private-label buyers evaluate suppliers. For exporters and roasters, this convergence of consumer sentiment and legislation turns compostable capsule packaging from a “nice-to-have” into a market entry requirement.

Compostable innovation: performance meets compliance

In the past, one of the biggest concerns with compostable capsule packaging was its ability to preserve coffee quality. Recent advances in PLA-based biopolymers and fiber-laminated barrier films have changed the conversation. Today, some engineered compostable capsule packaging can reach OTR ≈ 0.5–1 cc/m²/day under specified lab conditions, a threshold that meets the preservation needs of specialty coffee.

Equally important are the certifications backing these materials. Standards such as EN 13432 (EU) and ASTM D6400 (US) ensure that packaging breaks down within 90–180 days in industrial composting environments, without leaving toxic residues.

For B2B buyers, this means procurement teams can evaluate packaging choices not only on shelf-life performance but also on verifiable end-of-life credentials, ensuring alignment with regulatory and sustainability expectations.

For roasters and capsule brand owners, compostable capsule packaging is no longer a marketing experiment—it is becoming a market entry requirement in jurisdictions where sustainability is now legislated. Adopting compostable capsule packaging enables differentiation in premium retail channels, reduces future compliance costs, and builds long-term alignment with consumer values. For buyers evaluating suppliers, the key is not only asking “Is this compostable?” but also “Is it certified, proven in shelf-life trials, and scalable for export volumes?”

Bottom line for buyers: compostable solutions are no longer just a marketing story. In many markets they are becoming a precondition for retail listing and for mitigating future compliance costs.

Technical foundations: what makes compostable capsule packaging work

Switching to compostable systems is an engineering exercise as much as a sourcing decision. The technical constraints break down into three buyer-relevant areas:

Barrier performance (OTR/WVTR)

The technical backbone of compostable capsule packaging lies in biopolymer engineering and multi-layer barrier design. Unlike traditional multilayer plastics or aluminum composites that resist separation during recycling, compostable capsule pouches rely on carefully selected plant-derived polymers and cellulose-based laminates. These structures allow the material to degrade under the controlled conditions of an industrial composting facility.

From a performance standpoint, the focus is on balancing oxygen and moisture barriers with brewability. Too much barrier, and extraction may be hindered; too little, and coffee stales quickly. Manufacturers have now reached a point where capsule coffee bags can retain freshness for 6–9 months post-roast, comparable to conventional plastic-aluminum systems.

Sealing physics and production compatibility

PLA/PBAT blends and many compostable seal layers require different heat and dwell windows than conventional PE laminates. That can affect line speed and seam strength; poor sealing produces seam creep or micro-leaks during shipping. Ask suppliers for process windows (temperature, dwell, pressure) and run line trials at your co-packer before full scale ordering.

Brewing and mechanical stress compatibility

Capsules must survive storage, insertion, and high-pressure extraction (espresso: ~9 bar; commercial machines higher). Wall thickness, seam geometry and capsule rigidity interact with machine pierce mechanics and water flow. No matter how good the material’s lab OTR is, if the capsule bursts or extracts inconsistently, consumer complaints will destroy perceived quality.

This technical reliability is crucial for B2B buyers. For exporters, it means compostable capsule bags can travel long distances without quality compromise. For roasters, it means capsules can be marketed with both convenience and sustainability credibly in place.

The real operational risks — and how to turn them into procurement controls

To be useful, risk discussion has to be actionable. Procurement teams can turn common concerns into gating criteria and test protocols. Start by taking the supplier’s sustainability claim and translating it into verifiable items.

First, require whole-structure certification and the underlying lab reports. Certification alone is not enough; examine the test conditions, the composting classification (industrial vs home), and whether inks and adhesives are included.

Second, ask for measured OTR and WVTR results at specified temperatures and relative humidity. Don’t accept a single number without context. You will want test results at common thicknesses and conditioned at realistic RH/T combinations so you can compare formats fairly.

Third, insist on process windows and machine compatibility data. A supplier should provide sealing temperature, dwell time, pressure and expected throughput at nominal line speeds. As part of supplier validation, run an on-line production trial at the co-packer or supplier facility using your roast and intended run speed. Measure seam integrity, scrap rate and throughput loss.

Fourth, validate extraction behavior. Request third-party brew testing that reports extraction yield (TDS), sensory results and any mechanical failures after transport simulation.

Finally, map end-of-life reality. Certification only helps if infrastructure exists; map industrial composting availability in your target markets and be prepared for a dual-spec approach where you offer compostable SKUs where composting exists and recyclable mono-material SKUs where it does not.

Market signals and how early adopters have executed

Looking at what others have done helps turn theory into practice. Several mainstream retailers and private-label programs have already introduced compostable capsule lines and home-compostable offerings, signaling demand among eco-focused shoppers. One prominent supermarket launched own-label compostable capsules aimed at Nespresso-compatible systems; the move shows retailers are willing to back certified alternatives in major markets.

Smaller roasters have taken a pragmatic route: they started with limited runs or subscription-only capsules to test customer response and gather operational data. Those pilots often focused on three metrics: sensory stability over the intended distribution window, machine compatibility with common home machines, and actual disposal behavior (did customers compost correctly?). What emerges from these pilots is a repeatable pattern: start small, validate technically, and be explicit about disposal instructions.

For exporters, the lesson is clear. A dual-SKU strategy—compostable for urban EU markets with industrial facilities, recyclable mono-material for markets without compost options—reduces commercial friction while you scale supplier qualifications.

These case studies highlight how early adopters approached the transition in a controlled, data-driven way. For procurement teams, the question is how to replicate that discipline systematically rather than relying only on pilots or vendor promises. This is where clear performance indicators become essential. By aligning evaluation with measurable KPIs, buyers can compare suppliers objectively, reduce technical risk, and build a stronger business case for scaling compostable capsule programs.

KPI framework for evaluating compostable capsule packaging

- Shelf-life stability: Verified OTR/WVTR results under controlled conditions, combined with accelerated aging and sensory cupping over 6–9 months post-roast.

- Machine compatibility: Brew success rate (%) across common capsule systems (e.g., Nespresso-compatible, Keurig), plus machine-related complaint rate per 10,000 capsules.

- Sealing integrity: Scrap rate during production trials, seam failure rate after simulated shipping, and validation of supplier-provided heat-seal process windows.

- Certification validity: Verified whole-structure certification under EN 13432 / ASTM D6400, including inks, adhesives, and independent lab reports.

- End-of-life reality check: % of target market population with access to industrial composting, validated by consumer disposal compliance rates in pilot programs.

- Total cost of ownership (TCO): Comparative analysis of material premium, operational throughput loss, avoided regulatory fees, retail placement gains, and long-term customer loyalty or complaint reduction.

By embedding these KPIs into procurement RFPs and supplier evaluations, companies can move beyond “green storytelling” toward a disciplined, evidence-based sourcing strategy.

The road ahead: Cost, value and the TCO perspective

The compostable capsule packaging industry is moving fast. Research is expanding into home-compostable polymers, which could remove reliance on industrial composting infrastructure. Meanwhile, collaborations between packaging suppliers and capsule machine manufacturers are ensuring that compostable pouches perform seamlessly in existing brewing systems, avoiding compatibility issues.

For procurement teams, material cost is often the headline: compostable films typically carry a premium compared with commodity plastics. Yet this narrow view risks overlooking the broader financial and strategic picture. The right analysis treats compostable packaging not as a single-line cost increase but as an investment in market access, risk reduction, and long-term brand resilience.

When framed this way, three counterbalancing factors stand out. First, potential retail premium or placement gains: retailers and premium channels often reward sustainability credentials, which can translate into higher shelf prices or preferential shelf space. Second, regulatory avoidance: compliance costs, eco-levies or the administrative burden of Extended Producer Responsibility (EPR) can be significant, and compostable formats help minimize these future liabilities. Third, brand value: improved loyalty among eco-conscious consumers and reduced exposure to reputational risks are increasingly vital in competitive coffee markets.

The pragmatic way to operationalize this thinking is to build a Total Cost of Ownership (TCO) model that compares compostable capsule packaging with conventional alternatives. By capturing both direct and indirect cost drivers, such a model helps procurement teams make transparent, defensible decisions.

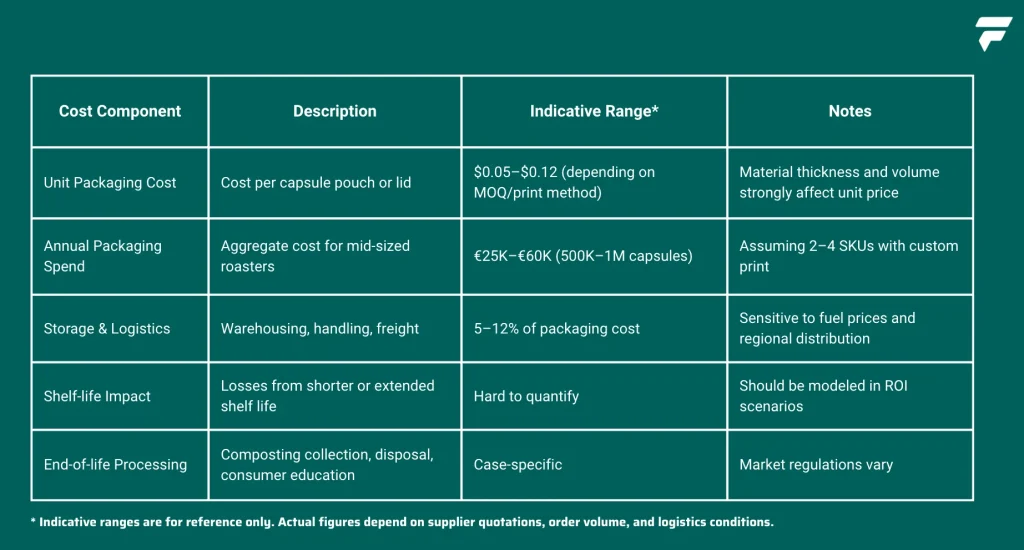

When evaluating compostable capsule packaging, brands need to look beyond unit price and assess the total cost of ownership (TCO). A simplified framework often used in procurement RFPs is shown below.

This template highlights that TCO is more than a unit price comparison. Many roasters discover that an apparent 10% premium can be offset within the first year once factors like avoided regulatory fees and potential retail uplift are considered.

By quantifying these categories, buyers can move from theoretical debate to practical investment logic. Many pilot programs show breakeven within 12–24 months once avoided compliance costs and retail premiums are accounted for, but exact outcomes depend on routes, volumes, and brand positioning.

The next five years will likely determine whether compostable capsule packaging becomes the default standard in single-serve coffee—or whether laggards risk being locked out of regulated and premium markets.

Conclusion: compostable capsule packaging as a strategic investment

Compostable capsule packaging is no longer a niche experiment, it is fast becoming a strategic requirement for coffee brands looking to thrive in regulated and sustainability-conscious markets. For roasters, it secures shelf life and unlocks access to premium channels. For exporters, it demonstrates professionalism, compliance readiness, and brand responsibility.

Adopting compostable capsule pouches and capsule coffee bags isn’t just about following a trend. It’s about future-proofing your supply chain, protecting your brand’s reputation, and aligning with the values of the next generation of coffee consumers.

👉 If your business is exploring compostable capsule packaging solutions, you can learn more about our custom options here: FernPack Compostable Capsule Packaging.